Development Insights - Auckland City Centre Residential Parking

Mon, December 12, 2022 | ParkingThis post from Malcolm McCracken, a Transport Planner at MRCagney, was originally posted on LinkedIn.

This article is the first in a series highlighting trends in urban development across Aotearoa. Over the past two years, I have been tracking and backdating multi-unit residential development across Auckland and other centres to understand trends in intensification and parking. This research aims to understand the effects of policy changes, like removal of parking minimums and upzoning, as well as how our urban environment is changing.

The Auckland City Centre is changing. My research indicates the average car park per unit ratio in new private residential developments over the past decade is around 0.65. This is lower than the regional average which is slightly above 1 car park per unit as of 2022.

This makes sense. The city centre is the best area for car free or car lite living because access by public transport, walking and cycling is so good. Equally, high land prices and construction costs mean car parks are expensive. A single car park in the Pacifica tower sold for a record-breaking $288,000 in 2021.

The high cost of parking means there are many developments with low, or no car parks in the city centre.

Library 27 is a recently completed mixed-use tower development on Rutland Street beside the Auckland Central Library. The development includes 49 apartments, with just six car parks which are reserved for the penthouse and sub-penthouse units.

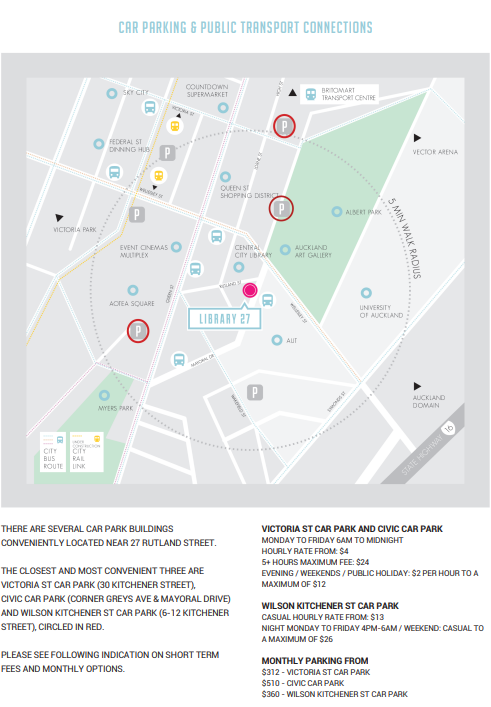

The combination of a constrained site, prime location, and proximity to public transport means delivering one car park per unit simply did not make sense. Instead, purchasers were provided with the location of the nearest parking buildings and the casual and monthly parking rates (Figure 1).

Figure 1: In the development brochure, prospective purchasers are encouraged to consider leasing car parks nearby if required

This approach allowed more homes to be constructed and at a more affordable price. Not having a large car park also made it easier to deliver a ground floor commercial space that engages ore positively with the street. A larger car park would have required a larger driveway entrance, dominating the ground floor of the site.

This approach gives freedom to buyers and renters of these units. They are not forced to pay for a car park bundled with their unit, but they still have options to lease one nearby if they need to. This freedom to choose car lite living makes the city centre attractive for people who don’t require a car frequently.

Car share is key to supporting car lite development.

Living in the city centre, gives its 40,000+ residents easy access to most of their needs, making it a convenient place to live. However, we have built our urban areas around car access for more than half a century, meaning that some trips do require a car. Car share supports reduced car ownership and consequently reduced requirements for car parking.

Car share allows users to book and collect a vehicle for private use, whether it be for an hour or multiple days. Typically fuel and insurance is included within an hourly rate, with daily caps keeping longer bookings affordable.

Providing car share in developments means that for those who do not need a car often, they are not required to own one or pay the costs of ownership including parking.

Car share options can be provided within the development, as has been done in Ockham Residential’s Daisy and many Built to Rent developments, or through public car share schemes like CityHop, Mevo and Zilch which already operate a in the Auckland City Centre.

Figure 2:Marketing from developer the Urban Collective questioning whether people need to own a carpark or even a car

While there may be an expectation for car parks, particularly at the higher end of the market, the industry is changing the way this is provided.

Many major tower developments have shifted to a valet parking model. This allows a shift to more space efficient parking solutions such as car stackers, car lifts, tandem or even triplet parking and the use of turn tables within a building. The valet model reduces risk of damage to equipment or vehicles with experienced operators.

65 Federal is one such development proposed to use this approach. The consented tower proposed 357 units but only 137 car parks. While some viewed this as a large number, it is *only* 0.38 car parks per unit and the total is a significant decrease on 427 spaces in the existing parking building.

While the development looks to now be on hold due to the market slowing down. This development highlights how the scale and method of providing parking is changing.

The proposed 65 Federal Tower with 137 car parks for 357 apartments, is one example of how residential parking is changing in new city centre developments (Image from ICD Property)

These trends are positive to see and align with the broader trajectory of the city centre which is becoming a more dense and vibrant mixed use neighbourhood every day. We are seeing significant private sector investments being realised, on the back of investments in the City Rail Link, Downtown programme and many more projects. The reduction in parking is key to supporting this.