Development Insights – Lower Hutt housing and the removal of parking minimums

Mon, December 19, 2022 | Housing | ParkingThis post from Malcolm McCracken, a Transport Planner at MRCagney, was originally posted on LinkedIn.

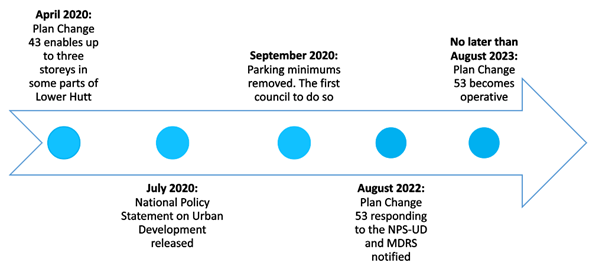

Hutt City Council were one of the first councils in Aotearoa to remove parking minimums in September 2020. This was just over one month after the release of the National Policy Statement on Urban Development and well ahead of the deadline to remove parking minimums in February 2022.

This decision, in combination with upzoning to allow medium density housing, has proven to be extremely successful in supporting more homes to be built with fewer carparks per dwelling.

Figure 1: timeline of policy changes completed and underway in Lower Hutt

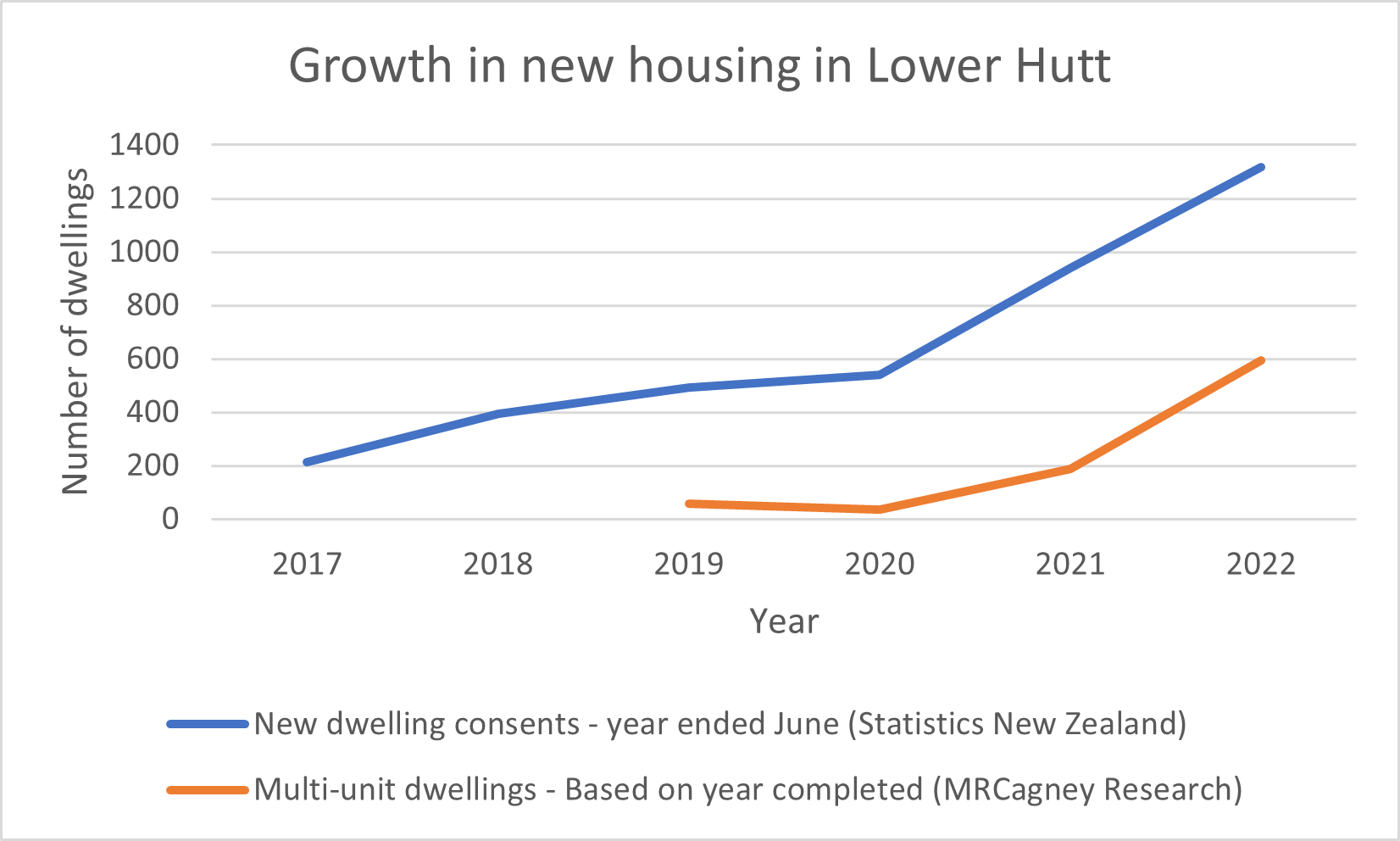

There was steady growth in new dwelling consents between 2017 and 2020, reflecting constrained housing supply and growth in house prices. In 2020, two plan changes occurred which boosted the number of dwellings consented the following year. Firstly, in April 2020, Hutt City Council Plan Change 43 was approved, enabling development of up to three storeys across many parts of Lower Hutt. This was followed by the removal of parking minimums in September. The following year saw nearly 75% growth in consented dwellings and the growth continued into 2022 (Stats NZ).

Figure 2: Growth in new housing in Lower Hutt

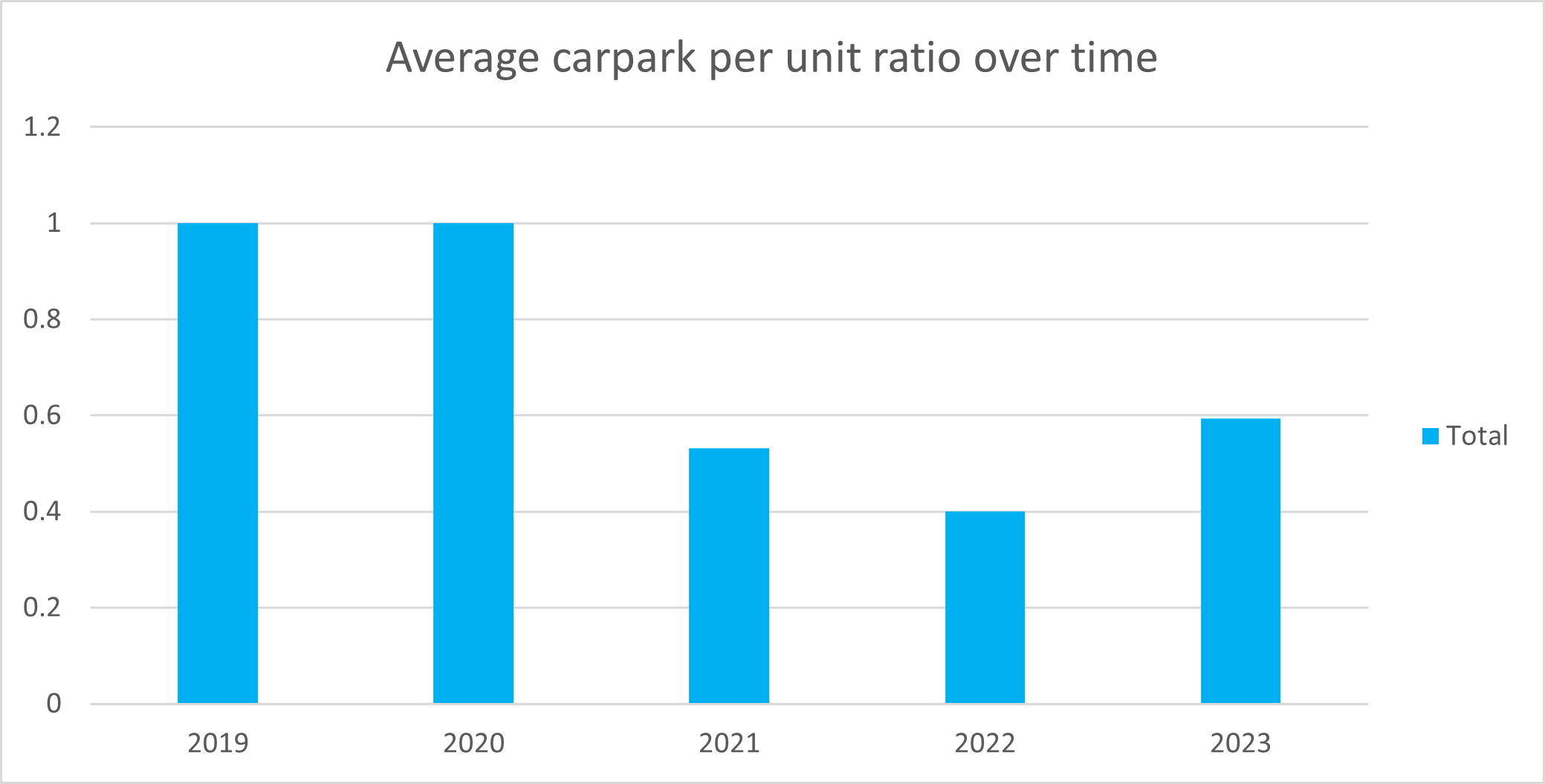

The removal of parking minimums has halved the number of carparks being built.

In the year following removal of parking minimums, the average car park per unit ratio across new multi-unit developments halved in Lower Hutt and is expected to be about 0.4 car parks per unit in 2022.

Figure 3: Average carpark per unit ratio over time for Lower Hutt multi-unit development

How this enables more homes is a simple spatial equation. On average a car park requires around 30m2 of land including access. Not providing carparks or less than one per unit enables more homes to be delivered on the site. Reducing the land costs component of each unit and delivering more affordable homes.

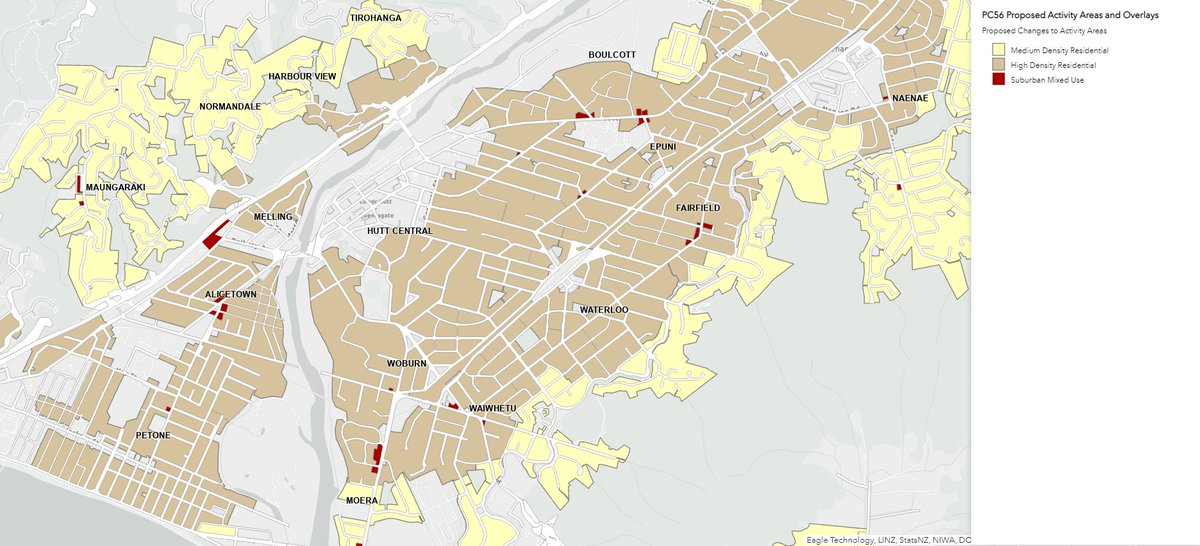

Figure 4 shows a recently completed 11-unit townhouse development in Taitā, Lower Hutt with just one car park. If this development required one or more car parks per unit, it would have required either underground parking or large driveway to access surface parking or internal garaging. This would likely lead to either less units being built and/or higher costs. Notable here is that Unit A which includes the carpark was $40-50,000 more than the equivalent 2 bedroom units.

Figure 4: Site plan of a townhouse development in Taitā with just one car park in the 11 units.

Unfortunately, the data publicly available from Stats NZ is unable to provide a break down of typology with the number of units consented at a Lower Hutt Council level. My own research shows that over 500 townhouses and apartments are set to be completed in the Lower Hutt City area in 2022. Due to time taken to process consents, market and sell dwellings and complete construction, we assume these dwellings would have been consented at least 9 months before completion. Therefore, we assume the majority of these 500 plus units were consented in 2021 or earlier and almost certainly on the back of these policy changes, otherwise they would have been unlikely to gain consent. We also can conclude that multi-unit dwellings will make up a significant portion of new dwellings to be completed in 2022 and number of new dwellings in multi-unit developments built is 10 times that in 2019 prior to the plan changes.

Due to the lack of publicly available data, it is difficult to conduct full statistical analysis on this. However, with our multi-unit housing and parking data, we can say that the combination of upzoning and removal of parking minimums, has allowed developers to better meet demand from investors and home buyers, for smaller and cheaper units with less land needed.

The market will provide parking, where there is demand.

Interestingly in 2023, the average carpark per unit ratio appears to be increasing slightly. This may be a response within the market as buyers seek the security and convenience that comes from owning off street parking. This will be particularly likely on streets where other developments have already occurred. What will be interesting is to see how developers price parking within developments and whether or not they unbundle parking.

For our Road Controlling Authorities, on-street parking management is extremely important to enforcing the market choice whether or not to buy a off-street carpark. By charging for parking, we can manage demand to ensure there is spaces available throughout the day for visitors, deliveries and supporting local businesses. If we have abundant and free on street parking, we subsidise the choice not to buy a car park off street.

Conclusions

The plan change alongside early adoption of removal of parking minimums has made Lower Hutt a great case study of benefits of planning reforms we are undertaking across Aotearoa and other parts of the world. The good news is that it doesn't stop here. Plan Change 53 which responds to the NPS-UD and Medium Density Residential Standards (MDRS) will be operative by August 2023. This will zone the majority of Lower Hutt for up to 6 storeys around the city centre and train stations, supporting further intensification which is critical for our future.

While increased interest rates may slow development in the short term, the reforms will position cities across Aotearoa well for greater housing supply, housing choice and intensification.

What is needed next? We need to make small scale commercial and retail a permitted (as of right) activity across all residential sites. This will support local mum and dad businesses and more vibrant and walkable neighbourhoods. Our upcoming resource management reforms provides the opportunity to deliver this.

This article is the second in my Development Insights series. This series builds upon my own research tracking commercial and multi-unit residential development in Aotearoa. Check out Part 1 here.